Rising property prices in Senegal are worrying more than one. Land speculation and the scarcity of land in Dakar are the causes most often cited by experts and laymen. Some believe that individuals in their frantic pursuit of profit are the main cause of the rise in prices. Certainly, speculators exist, but to hold them entirely responsible would be a reductive analysis which would leave parts of the problem unexplored.

One of the phenomena that is rarely discussed is the inflationary nature of real estate transactions in Senegal. Today, even if the State prohibited the realization of a capital gain on real estate transactions and all real estate speculators were eliminated, Senegal would still experience a dizzying rise in real estate prices due to the inflationary nature of real estate transactions. In other words, transaction costs are also factors explaining the price increase.

In this article, we explore these transaction fees and provide some suggestions for improving this situation which could harm future generations.

Table des matières

Inflationary transaction fees

To analyze the inflationary nature of real estate transactions in Senegal, take the case of Aida Dramé, a young executive who decides to buy land in Golf Sud for an amount of 33 million FCFA. Because this is a lease, Aida must go through the notary. To formalize this transaction, Aida pays 2 million FCFA HT to the State of Senegal and 1.3 million FCFA HT to the notary. It totals costs of around 3.5 million FCFA including tax, or 10.77% of the price of the land.

Suppose Aida decides to finance her acquisition with a mortgage loan, again, she must go through the notary. It is responsible for additional transaction costs associated with taking out the mortgage in addition to bank charges. Aida thus subscribes to a loan of 38 million FCFA to be able to cover all the costs. This time, she pays 400,000 FCFA before tax to the State of Senegal and 900,000 FCFA before tax to the notary, or about 1.5 million FCFA including tax. There is also the cost of opening a credit file of around 380,000 FCFA.

Aida is finally the owner. The cost of the land is around 38 million FCFA including tax. Note the intriguing phenomenon caused by the transfer of ownership: the value of the land is artificially inflated from 33 million FCFA to 38 million FCFA, an increase of 15% on the price claimed by the seller. If tomorrow, Aida felt the need to resell her land, she could not sell it for less than 38 million FCFA (not counting the increased bank interest to date). However, Aida is not in a speculative logic and will not make a profit on this transaction if it claims 38 million from a buyer. Quite simply, the inflationary nature of real estate transactions promotes accelerated growth in real estate prices in Senegal.

Imagine the perverse effect of this phenomenon on the scale of all real estate transactions in Senegal. This effect is amplified by the asymmetry of market information. Aida Dramé’s neighbors naturally think that their land is also worth FCFA 38 million, since Aida was able to find a buyer at that price.

Breakdown of real estate transaction costs

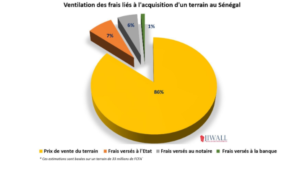

The graph below illustrates the breakdown of costs related to a real estate transaction in Senegal. The fees consist of taxes paid to the State, notary fees and certain bank charges.

State taxes

It should be noted that most of the value of land is created by the State through the development of roads, the establishment of health and education infrastructure, the provision of public transport, etc. . Therefore, 7% to the state in addition to the capital gains taxes charged to the seller is relatively justifiable, even if it is not consistent with the general objective of making housing affordable in Senegal.

Apparently the new finance law provides for a reduction in these fees for real estate developers. This law should perhaps be extended to individuals knowing that self-construction represents 80% of housing in Senegal.

Bank charges

On the other hand, the file opening fee of 1% of the loan amount imposed by the banks is difficult to justify. As a reminder, operational costs are already included in bank interest rates. In a logic of coherence with the housing policy, the State should look into these subjects.

Notary fees

The notary is the trusted third party who secures all real estate transactions. But even when it comes to our health, we want to make sure we’re paying the right price, so the notary’s fees cannot be spared from this critical exercise. In order to have a little more perspective on the fees of notaries, let’s compare the remuneration of French notaries to that of Senegalese notaries. We will again use the example of Aida Dramé who buys land in Senegal for 33,000,000 FCFA.

|

France |

|||

| Base slice (FCFA) | Amount Applicable | rate | Proportional fees |

| From 0 to 4 257 000 | 4 257 000 | 3,95% | 167 939 |

| From 4 257 000 to 11.135.000 | 6 878 000 | 1,63% | 111 905 |

| From 11 135 000 to 39 300 000 | 21 865 000 | 1,09% | 237 235 |

| More than 39 300 000 | 0 | 0,81% | 0 |

| 517 079 | |||

|

Sénégal |

|||

| Tranche d’assiette (FCFA) | Montant | Taux applicable | Emoluments Proportionnels |

| De 0 à 20 000 000 | 20 000 000 | 4,50% | 900 000 |

| De 20.000.000 à 80.000.000 | 13 000 000 | 3% | 390 000 |

| De 80.000.000 à 300.000.000 | 0 | 1,50% | 0 |

| Plus de 300 000 000 | 0 | 0,75% | 0 |

| 1 290 000 | |||

For the same transaction, Aida Dramé would have paid 517,079 FCFA before tax in France, which is 2.5 times less than in Senegal. And this multiple would vary upward if the transaction amount were to increase. We are quite skeptical that the effort made by a Senegalese notary to secure a real estate transaction is 2.5 times greater than that of the French notary.

Suggestions to improve the situation

A tax exemption for non-speculative non-investors

Real estate is a particular asset class attracting interests ranging from speculation to finding a home, which is a basic need. It is important that the state takes this consideration into account when putting in place fiscal policies. Self-construction represents the majority of real estate production in Senegal. Limiting tax measures to property developers cannot accomplish the intention of facilitating access to housing in Senegalese. Ways need to be found to reduce the tax burden on people looking for a home.

Expanding the role of notaries

As mentioned above, the role of the notary is essential to guarantee the transparency of real estate transactions. To date in Senegal only transactions on land titles and leases are required to go through a notary. While many real estate transactions are made on land in the national domain. These transactions are often the source of land disputes that ruin the investment of so many brave Senegalese. It is obvious that local authorities have neither the expertise nor the means to manage these transactions. By extending the intervention of the notary to all types of real estate transactions, it will be easier to reduce the costs of notaries without affecting them. By the same means all real estate transactions would be secure.

Increase in the number of notarial offices

Naturally, the expansion of the role of the notary must be accompanied by the increase in notarial offices. Senegal has only 50 notarial offices (http://seninfogreffe.com/) for the 15.8 million inhabitants (World Bank), or 1 notary for 317,000 inhabitants. By way of comparison, in France, for a population of 67 million inhabitants (INSEE, January 2020), there are more than 6,580 notarial offices (notaires.fr), or 1 notary for 10,180 inhabitants. There are 30 times more notaries per capita in France than in Senegal. It would also be an opportunity to create and accelerate the formalization of our economy.

In conclusion, beyond real estate speculation, it is important to note that there are fundamental realities that exacerbate the housing problem in Senegal. Everyone needs to be part of the resolution if we are to prosper as a united nation. Whether it is the State, notaries or banks, it is essential to reduce the transaction costs of real estate.